Car Loan Early Payoff Calculator

Car Loan Early Payoff Calculator

Calculate how much you can save by paying off your car loan early

Loan Details

Payment Strategy

Extra Payment

Add fixed amount monthly

Target Date

Set specific payoff date

Lump Sum

One-time large payment

Bi-weekly

Pay half monthly, twice per month

Results Summary

| Strategy | Monthly Payment | Payoff Time | Total Interest | Savings vs Original |

|---|---|---|---|---|

| Original Loan | $487 | 48 months | $4,347 | -$0 |

| Extra $50/month | $537 | 40 months | $3,521 | +$826 |

| Extra $100/month | $587 | 34 months | $2,874 | +$1,473 |

| Lump Sum $2000 | $487 | 42 months | $3,652 | +$695 |

Are you paying more than necessary on your car loan? With the average auto loan interest rate hovering around 7-9% in 2025, millions of Americans are overpaying on their vehicle financing. Our Enhanced Car Loan Early Payoff Calculator helps you discover exactly how much you can save by implementing smart payment strategies.

Unlike basic calculators that only show simple extra payment scenarios, our advanced tool provides comprehensive analysis with interactive visualizations, multiple payment strategies, and real-time comparisons to help you make informed financial decisions.

Why Use a Car Loan Early Payoff Calculator?

The Financial Impact of Early Payoff

According to recent Federal Reserve data, the average car loan balance in America is approximately $23,792 with terms extending 60-84 months. By paying off your loan early, you can:

- Save thousands in interest payments

- Improve your debt-to-income ratio

- Free up monthly cash flow for other investments

- Own your vehicle outright sooner

- Reduce financial stress and risk

Real-World Example

Consider a typical scenario:

- Loan Amount: $25,000

- Interest Rate: 6.5%

- Original Term: 60 months

- Monthly Payment: $489

By adding just $100 extra per month, you could:

- Save $1,547 in interest

- Pay off 10 months early

- Total savings: $1,547 + (10 × $489) = $6,437

Revolutionary Features of Our Enhanced Calculator

1. Multiple Payment Strategies

Our calculator goes beyond basic extra payment calculations with four distinct strategies:

Extra Monthly Payment Strategy

- Add any fixed amount to your monthly payment

- See immediate impact on payoff timeline

- Calculate exact savings potential

Target Date Strategy

- Set your desired payoff date

- Calculate required monthly payment

- Perfect for goal-oriented budgeters

Lump Sum Payment Strategy

- Apply windfall payments (tax refunds, bonuses)

- Choose when to apply the payment

- See long-term impact of one-time payments

Bi-weekly Payment Strategy

- Pay half your monthly payment every two weeks

- Equivalent to 13 monthly payments per year

- Automatic acceleration without feeling the pinch

2. Advanced Interactive Visualizations

Savings Doughnut Chart

- Visual representation of interest saved vs. remaining interest

- Instantly understand your savings potential

- Color-coded for easy interpretation

Payment Comparison Bar Chart

- Side-by-side comparison of original vs. new payments

- 24-month projection view

- Clear visual impact of payment changes

Balance Progression Line Chart

- Track how your loan balance decreases over time

- Compare original timeline vs. accelerated payoff

- Understand the compound effect of extra payments

3. Real-Time Strategy Comparison

Our comprehensive comparison table shows:

- Original loan terms

- Multiple extra payment scenarios ($50, $100, $200)

- Bi-weekly payment impact

- Side-by-side savings analysis

- Time reduction for each strategy

4. Smart Progress Indicators

Dynamic progress bars show:

- Interest savings percentage

- Time reduction percentage

- Visual motivation to stay on track

5. Export and Documentation Features

- Print-friendly results for record keeping

- CSV export for spreadsheet analysis

- Professional formatting for financial planning

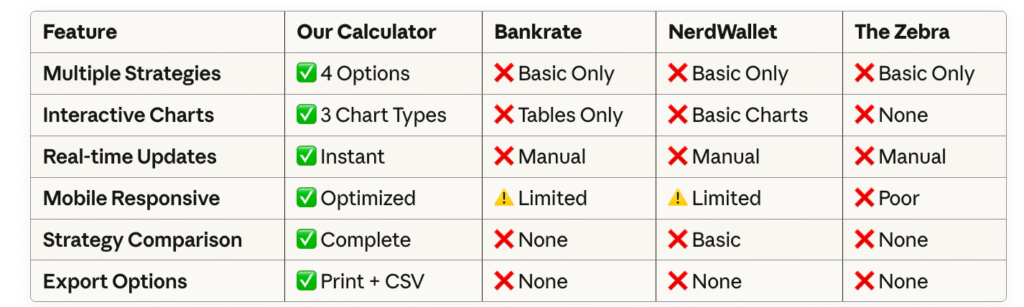

How Our Calculator Outperforms the Competition

Comparison with Leading Calculators

Key Improvements Over Existing Tools

- Visual Learning: Interactive charts make complex calculations easy to understand

- Comprehensive Analysis: Multiple payment strategies in one tool

- Educational Value: Tooltips and explanations throughout

- Modern Interface: Responsive design that works on all devices

- Professional Results: Export capabilities for financial planning

Step-by-Step Guide: Using the Calculator

Step 1: Enter Your Loan Details

- Loan Amount: Original amount borrowed

- Interest Rate: Annual percentage rate (APR)

- Loan Term: Original length in months

- Remaining Balance: Current amount owed

- Months Paid: Payments already made

Step 2: Choose Your Payment Strategy

Select from four strategic approaches:

- Extra Payment: Add fixed monthly amount

- Target Date: Set specific payoff goal

- Lump Sum: Apply windfall payment

- Bi-weekly: Automatic acceleration method

Step 3: Analyze Your Results

Review comprehensive analysis including:

- Total interest saved

- Time reduction

- New payoff date

- Required payment amount

Step 4: Compare Strategies

Use the comparison table to evaluate multiple approaches and choose the best fit for your financial situation.

Step 5: Export and Plan

Print or export your results for:

- Financial planning sessions

- Budget adjustments

- Progress tracking

Expert Tips for Maximizing Your Savings

1. Start Small and Increase Gradually

Begin with an extra $25-50 per month and increase as your budget allows. Small consistent amounts compound over time.

2. Use Windfalls Strategically

Apply tax refunds, bonuses, or raises directly to your loan principal for maximum impact.

3. Consider the Bi-weekly Strategy

This “set it and forget it” approach requires minimal effort but delivers significant results.

4. Review and Adjust Regularly

Reassess your strategy quarterly as your financial situation evolves.

5. Avoid Prepayment Penalties

Check your loan terms for early payoff penalties that might offset your savings.

When NOT to Pay Off Your Car Loan Early

While early payoff generally saves money, consider these scenarios:

Low Interest Rate Loans

If your rate is below 3-4%, investing extra funds might yield better returns.

High-Interest Debt

Prioritize credit cards or other high-rate debt first.

Emergency Fund Gaps

Maintain 3-6 months of expenses before accelerating loan payments.

Investment Opportunities

Consider if investing extra funds could generate higher returns than loan interest saved.

The Mathematics Behind Early Payoff

Compound Interest Impact

Every extra dollar paid toward principal reduces the base amount for future interest calculations. This creates a compounding effect where savings accelerate over time.

Formula Breakdown

Our calculator uses the standard amortization formula: