Advanced Credit Card Interest Calculator

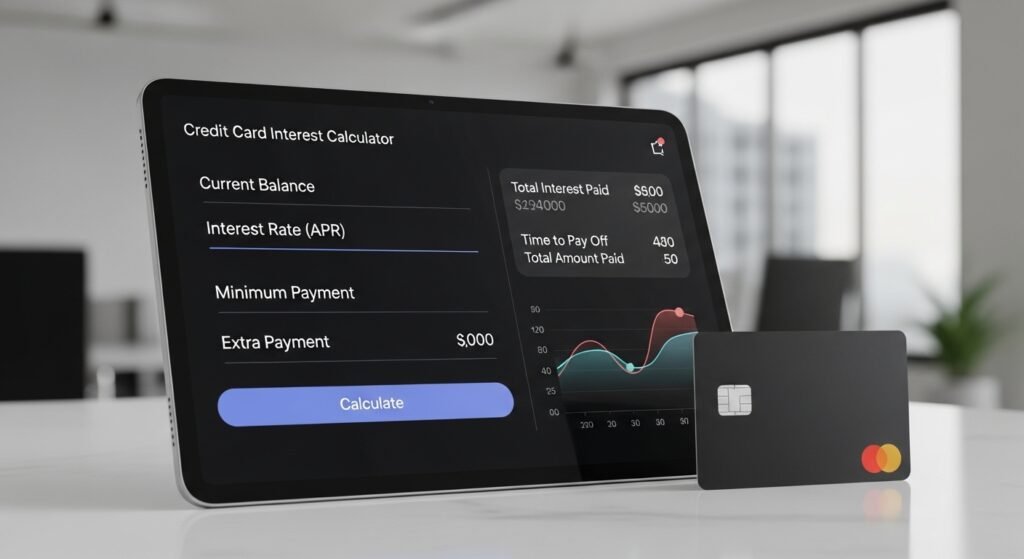

We built the Advanced Credit Card Interest Calculator to give you the power and clarity you need to break free from debt faster and save thousands of dollars in interest. Unlike basic online tools, our calculator provides a dynamic, visual, and comprehensive analysis that empowers you to take action.

Your Debt Details

Payoff Scenarios at a Glance

Compare the total cost and time to pay off your debt using different payment strategies.

Minimum Payment

Fixed Payment

Fixed + Extra Payment

Debt Payoff Timeline

This chart shows how your balance decreases over time for each payment scenario.

Take Control of Your Debt: The Ultimate Credit Card Interest Calculator

If you’ve ever felt trapped by credit card debt, watching your balance shrink at a snail’s pace while interest charges pile up, you’re not alone. The minimum payment trap is a reality for millions, but it doesn’t have to be your story.

What Makes Our Calculator Different? (E-E-A-T)

Our tool was developed with a deep understanding of the challenges real people face when managing debt. We went beyond simple calculations to provide a platform that is not just accurate, but genuinely helpful.

The Problem with Simple Calculators

Most calculators give you a single, static number and leave you to do the rest. This lack of context and comparison makes it hard to see the true cost of inaction. You’re left asking:

- “How much faster would I be done if I paid an extra

$50?” - “What is the total interest I’ll pay over the life of this debt?”

- “Can I see my progress over time?”

Our Solution: A Professional-Grade Tool for Everyone

Our calculator is built on the same financial principles used by debt professionals, but with a user-friendly interface. We believe that everyone deserves access to high-quality financial tools to make better decisions. This is where the power of our tool shines through, providing you with real-time insights and a clear path forward.

Revolutionary Features That Accelerate Your Payoff

Our Advanced Credit Card Payoff Calculator is packed with features designed to give you a strategic advantage over your debt.

🎯 Real-Time Scenario Comparison Don’t guess which payment strategy is best. Our tool instantly compares three scenarios side-by-side:

- Minimum Payment: The slow, costly path your credit card company wants you to take.

- Fixed Payment: A consistent, accelerated payment that significantly shortens your timeline.

- Fixed + Extra Payment: The most powerful scenario, showing how a little extra each month can make a massive impact on your total interest paid and payoff date.

📊 Interactive Payoff Timeline A visual representation is worth a thousand numbers. Our dynamic chart shows you exactly how your balance decreases over time for each scenario. You can see the impact of your choices with your own eyes, making the journey to a zero balance feel real and achievable.

💰 Advanced Debt Metrics at a Glance We calculate the most important metrics instantly:

- Total Interest Paid: The true financial cost of your debt.

- Time to Payoff: Your exact debt-free date.

- Total Savings: The amount of money you save by choosing a smarter payment strategy.

📱 Mobile-Optimized Experience We know that financial decisions happen everywhere. Our calculator is built with a mobile-first approach, ensuring it works flawlessly on your phone or tablet, so you can make informed choices no matter where you are.

How to Use the Advanced Credit Card Payoff Calculator

Getting started is easy and takes less than a minute.

- Input Your Debt Details: Enter your current balance, the APR, and your card’s minimum payment percentage.

- Define Your Strategy: Choose a fixed monthly payment you’re comfortable with. Then, enter any additional “extra” payment you’d like to make to see the power of acceleration.

- See the Results: Watch as the calculator instantly populates the key metrics and the visual chart, showing you your best path forward.

Frequently Asked Questions (FAQs)

Q: Is this credit card payoff calculator free to use? A: Yes, our Advanced Credit Card Payoff Calculator is completely free to use, with no registration required. We believe financial empowerment should be accessible to everyone.

Q: How accurate are the calculations? A: Our tool uses standard amortization formulas that are widely accepted in the financial industry. The results are highly accurate based on the information you provide.

Q: Why is paying the minimum so bad? A: The minimum payment is often structured to keep you in debt for decades, costing you thousands in interest. Our calculator clearly demonstrates the significant difference in time and money between paying the minimum and making a more aggressive payment.

Q: Can this calculator help me save money on interest? A: Absolutely. By showing you the Total Interest Paid for each scenario, you can see exactly how much you can save by simply increasing your monthly payment.

Q: I have a few credit cards. How should I use this tool? A: You can use our calculator to analyze each card individually. A common strategy is the “debt avalanche” method, where you focus on paying off the card with the highest APR first. This strategy saves you the most money in the long run.

Q: Does the calculator work on my phone? A: Yes! The calculator is designed with a responsive, mobile-first approach, ensuring it works seamlessly on any device.

Start Your Debt-Free Journey Today

Don’t let another month go by making a minimum payment that barely touches your principal. Use our Advanced Credit Card Payoff Calculator now to create a clear plan, save money on interest, and finally take control of your financial future.

Disclaimer: This calculator is for educational and informational purposes only. It is not financial advice. Always consult with a qualified financial professional before making significant financial decisions.